Despite economic and political uncertainties, growth remains at the top of numerous organizations’ agendas as the main reason for any M&A.

While different non-IT-related nuances are involved in any M&A process, technology issues also play a vital role. Meanwhile, the consolidation and conversion of data in oil and gas industry M&As is the most important of all. As the sector is data-driven, success largely depends on how well you handle the transition of records and documents. So, no matter whether you hire an external partner to handle your mergers and acquisition data migration services or plan to deal with all the processes in-house, knowing hidden pitfalls and effective approaches is vital. So, we share our best practices to help you pass all the growth rounds quickly and successfully.

Defining the best approach to migrating data

M&A ventures are challenging for CIOs and CFOs, as they impact two sides: business and technology. That’s why you need an approach that addresses both.

Determining the appropriate data migration types, systems, and applications for integration can be difficult and time-consuming. Meanwhile, missteps can lead to oil and gas data loss, unwanted technical debt, and system downtime. Since the average IT downtime costs more than $300,000 an hour for SMEs and larger organizations, you can see how crucial a well-thought-out roadmap is.

A transparent strategy, careful planning, and relevant data migration techniques will bring efficiency and ensure smooth data migration for M&A. Meanwhile, strategies and types of data center migration flows differ in specifics, but usually, they all include typical steps.

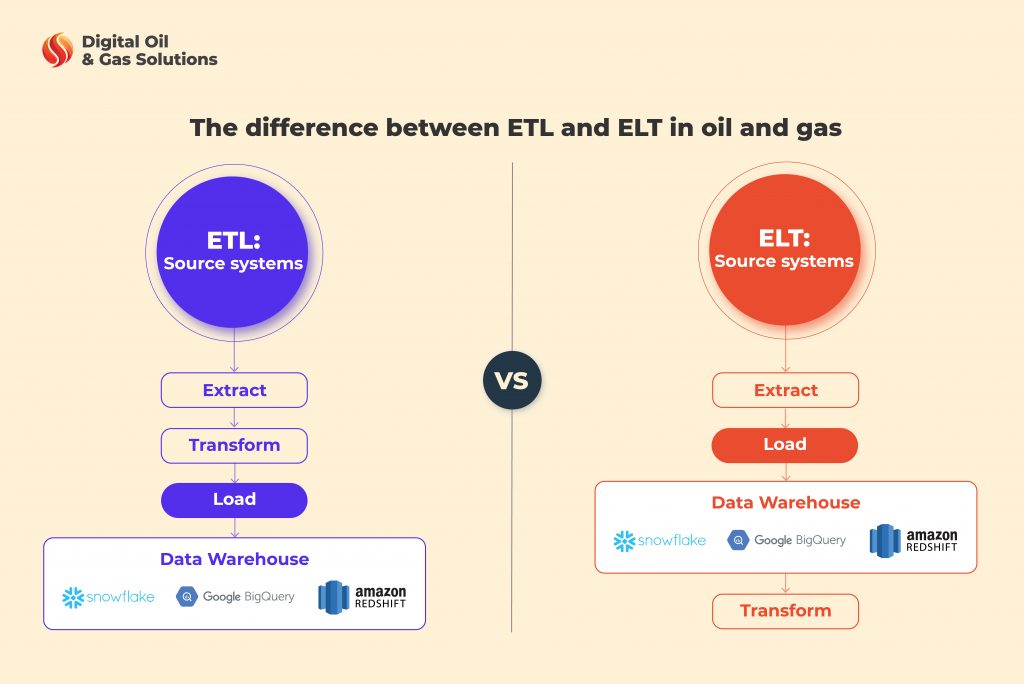

As extraction and transformation of source information are vital parts of the process, you may want to gain insights into migrating data using ETL vs ELT methods. These tools for data migration can address the difficulties of processing massive datasets, profiling, and consolidating multiple applications.

ETL vs ELT: what’s the difference and when to use them?

Extract, Transform, and Load (ETL) means extracting information from your systems, converting (transforming) it in a necessary way, and loading it into the targeted system. Though there are a few popular ETL tools for data migration, they don’t guarantee fulfilling all your requirements. Therefore, specialists often build custom ETLs to get through complex real-time challenges.

Meanwhile, ELT extracts records and loads them directly into the target destination. It can accept unstructured, raw data requiring no manipulation before storage.

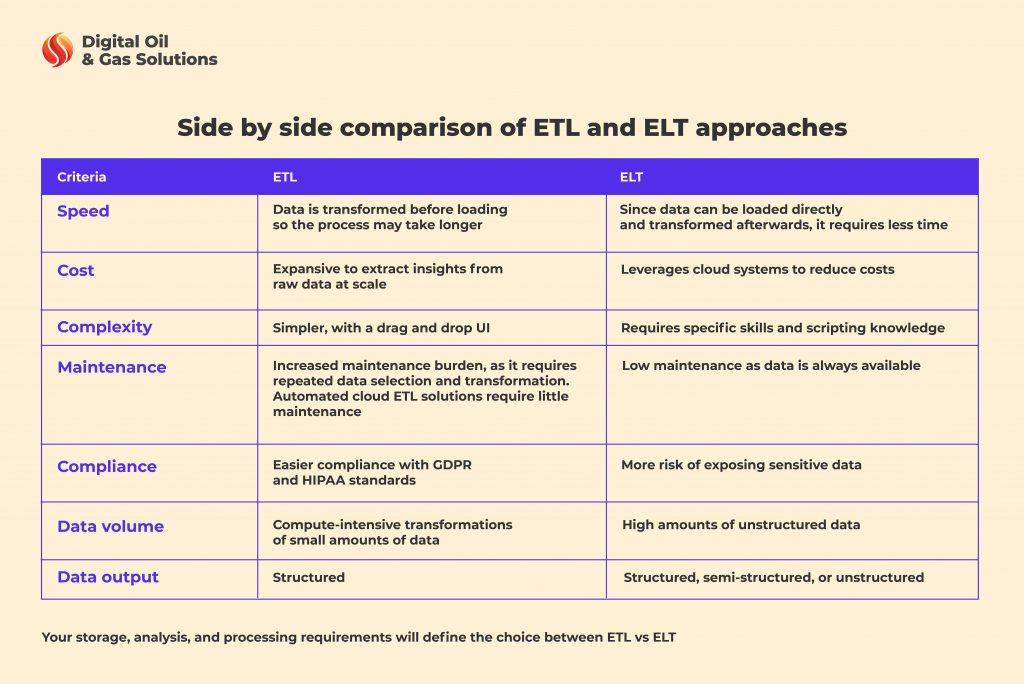

So, ETL vs ELT, which is better? The answer depends on your source data, conditions, and goals. ETL data migration is a viable solution for converting on-premises, structured data sets and sensitive information that require stronger security. The ELT method is appropriate for moving data to the cloud, offering more flexibility to convert it for analytics, BI, or predictive modeling at any time. Below you can see a detailed comparison of ETL vs ELT methods that may help you choose the more suitable option for your case.

Strategic insights to navigate M&A data in oil and gas industry complexity

Finally, let’s talk about data migration services and how to successfully consolidate data in oil and gas industry M&As.

1. Review the state of each organization’s data

When you acquire a company, you also acquire its data. So, you may end up grappling with two entirely different worlds of applications and systems that confound your efforts to control information. So, first, you should assess the data maturity of all entities in the M&A activity to set expectations and start planning your next steps. Closely examine the information you’re going to merge. Organizations can and should resolve quality issues in existing systems and ideally have a decent oil and gas data management strategy.

Look for outdated records or those that are no longer necessary. Also, understand if you have data requiring more stringent safety controls and compliance with regulations. Use this as an opportunity to cleanse the content to build a sustainable, functional, and consolidated platform for the merged company.

2. Create a plan and follow it

You should determine what information you need, where to move it, and how you’ll do that. Outline each step, the participants, and their roles and responsibilities in migrating data. Make sure to involve data integrity and security strategies. Beyond a structured, detailed procedure, a good plan incorporates a list of the right software tools for data migration.

Things can get out of control. So, consider the possible compatibility or technical problems and the system’s downtime. We also recommend you test data migration roadmaps first to ensure you will eventually reach the desired result. You may need to adjust your strategy and make immediate decisions after performing data migration testing. But after all, you will ensure the transition will involve minimal effort.

3. Implement strong data governance and ownership

Business owners should manage data in oil and gas industry cases before, during, and after the migration process. Take charge and responsibility for your data as a strategic asset. In this case, you can establish a sound basis for high-quality governance and introduce data insight solutions oil and gas companies benefit from. Taking into account SCADA data protocols, oil and gas companies should also ensure seamless communication between systems, as well as safe data exchange. By doing so, you will strengthen your merged organization’s overall digital capability and mitigate possible risks.

4. Leverage the appropriate tools

The lack of tools for data migration is one of the major causes of transition failure. This is why you should equip your team with smart solutions that will eliminate the headache, speed up the process, and give more valuable outcomes. Search for options that automate processes and data migration testing techniques, drive transparency, and provide robust analytics capabilities. Relevant offers like data management as a service will support your efforts and streamline intricate components of your project.

5. Lean on third-party expertise

A merger and acquisition is a rare case for most oil and gas organizations. As a result, you may lack in-house data migration experience to deal with it efficiently. Or, you may not have a specific department specializing in various types of data migration approaches that can deliver a smooth M&A project. Meaning you shouldn’t navigate an M&A on your own. Gain necessary domain expertise paired with automated AI solutions and global best practices by hiring migration services for M&A data in oil and gas industry spheres.

Common data challenges during mergers and acquisitions

Based on our experience, we highlight common obstacles that often remain overlooked and hinder the process:

- Poor planning. Converting and migrating data is among the most troublesome tasks in carrying out M&A. Improper analysis of the project scope can lead to the flawed implementation of transition and cost overruns.

- Data silos. You may find that the information from the acquired company is scattered in various information sources, which are isolated, incompatible formats within a large system. Such silos have messed up lots of data migration undertakings. The variety and volume of information are growing tremendously, making it difficult for organizations to break the complex silos and drive insights.

- Duplicated and obsolete data. Assuming the data you hold has no quality issues can be a costly mistake, which multiplies when you merge it from multiple systems. Minor spelling errors, incorrect information, and duplicate records could lead to critical failures in the process.During M&A, your data is more vulnerable than ever. When files are moved around and access permissions are modified, the risk of loss or breaches increases.

- Compliance. M&A can create an additional layer of complexity because of new considerations around geographic or industry-specific regulations. The acquired organization may be subject to more stringent legislative norms on data security than the other.

- Lack of expertise. An incomplete understanding of the process and a lack of relevant skills can lead to errors that generate unexpected costs. You may rely on your IT department to conduct the data migration in-house. However, not all IT professionals are good at software architecture, database systems, and app security.

Key takeaways

Migrating data from several sources that you want to merge into one consolidated new system is challenging and risky. We know that underestimating the scale and complexity of such projects can result in a rush and higher probability of poor data in oil and gas industry M&As.

If you’re concerned about the associated risks, you should find a reliable partner to secure your M&A. With our SCADA data oil and gas solution and expertise in migrating big data in oil and gas industry, we help avoid common problems of M&A procedures and reduce risks. Along with data migration, cleansing, and a full inventory, our technology and experts analyze essential information to detect potential issues and help you make thoughtful decisions before it’s too late. Third-party expert support will remove one thing to worry about during a hectic time.

Source link

#Title #data #migration #steps #merge #data #oil #gas #industry #successfully