Welcome to this week’s Market’s Compass Emerging Markets Country ETF Study, Week #394, that is being published in our Substack Blog. It will highlight the technical changes of the 22 EM Country ETFs that we track on a weekly basis and publish every third week. Paid subscribers will continue to receive the Weekly ETF Studies sent directly to their registered email. This week, in celebration of the 4th of July holiday, we are sending the complete Emerging Markets Country ETF Study to both paid and free subscribers. Past publications can be accessed by subscribers via The Market’s Compass Substack Blog. Next week we will be publishing the The Markets Compass US Index and Sector ETF Study.

Last Week’s and 8 Week Trailing Technical Rankings of the Individual EM ETFs

The Excel spreadsheet below indicates the weekly change in the Technical Ranking (“TR”) of each individual ETF. The technical ranking or scoring system is an entirely quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. If an individual ETFs technical condition improves the Technical Ranking TR rises and conversely if the technical condition continues to deteriorate the TR falls. The TR of each individual ETF ranges from 0 to 50. The primary take away from this spread sheet should be the trend of the individual TRs either the continued improvement or deterioration, as well as a change in direction. Secondarily, a very low ranking can signal an oversold condition and conversely a continued very high number can be viewed as an overbought condition, but with due warning, over sold conditions can continue at apace and overbought securities that have exhibited extraordinary momentum can easily become more overbought. A sustained trend change needs to unfold in the TR for it to be actionable. The TR of each individual ETF in each of the three geographic regions can also reveal comparative relative strength or weakness of the technical condition of the select ETFs in the same region.

The largest drop of the three EM region Total Rankings since we last published on June 13th was the LatAm region. The Total Lat Am Ranking has dropped -37.18% to 62.5 from 99.5 three weeks ago versus a small drop in the Total Asia-Pacific Ranking to 102.5 from 108.5 and a slight improvement in the Total EMEA Ranking to 90.5 from 84.5. The drop in the Total Lat AM Ranking is technically noteworthy since none of the five ETFs in that region were in the “red zone” in late-May to early-June. For the third week in a row the iShares MSCI South Korea Index Fund ETF (EWY) sported the lowest EM TRs at 1, 2, 1 respectivly. On the positive side of the ledger there has been a gradual improvement in the TR of the iShares FTSE/Xinhua China 25 Index Fund ETF (FXI) since early-May and over the past three weeks the FXI has registered the highest TRs. Because of the higher weighting of Chinese equities in the EEM there has been a measure of price stability in the ETF (it has avoided printing a new low). The top 15 holdings in the EEM is posted below (the daily chart and comments on the short-term technical condition of the EEM is posted later in the blog). A chart of the FXI vs. the EEM that reflects the recent better relative performance versus the EEM and a daily price chart of the FXI follow the top 15 holdings in the ETF.

Top 15 Holdings in the EEM

Top 15 Holdings in the FXI

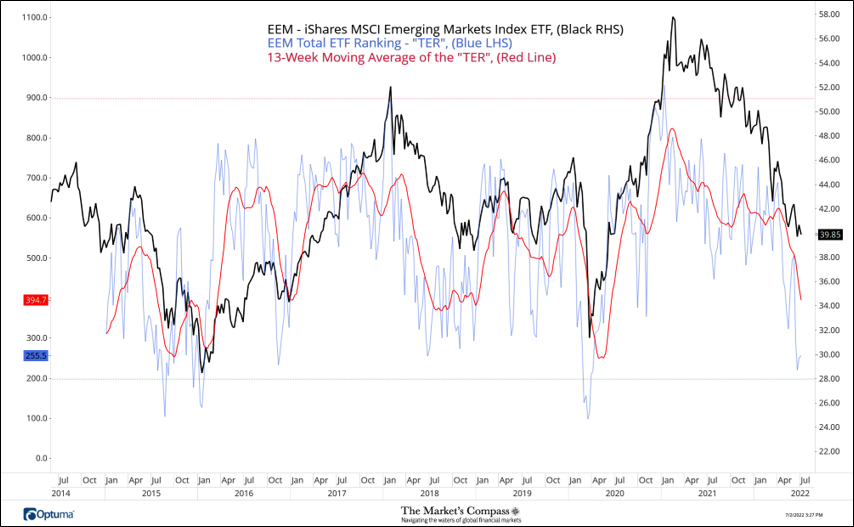

The EEM with the Total ETF Ranking “TER” Overlayed

The Total ETF Ranking (“TER”) Indicator is a total of all 22 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator. As a confirmation/divergence tool: If the broader market as measured by the iShares MSCI Emerging Markets Index ETF (EEM) continues to rally without a commensurate move or higher move in the TER the continued rally in the EEM Index becomes increasingly in jeopardy. Conversely, if the EEM continues to print lower lows and there is little change or a building improvement in the TER a positive divergence is registered. This is, in a fashion, is like a traditional A/D Line. As an overbought/oversold indicator: The closer the TER gets to the 1100 level (all 22 ETFs having a TR of 50) “things can’t get much better technically” and a growing number individual ETFs have become “stretched” the more of a chance of a pullback in the EEM. On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of ETFs are “washed out technically”, a measurable low is close to being in place and an oversold rally will likely follow. The 13-week exponential moving average, in red, smooths the volatile TER readings and analytically is a better indicator of trend.

The EEM Total Technical Ranking (“TER”) of the 22 Emerging Market Country ETFs rose only slightly over the past two weeks from the lowest reading since April 2020 at 220. Although it did come close the TER did not enter oversold territory. We remind readers that because a good number EM ETFs are thinly traded and are subject to wide swings, which in turn creates volatile individual Technical Ranking changes, that the calculation of the TER also fluctuates in a similar manor. Analytically, focusing on the 13-week moving average of the TER is a far better indicator. That moving average has continued to track sharply lower despite the small +16.14% gain in the TER over the past two weeks. Aside from the short-term price stabilization, as can be seen in the detailed weekly candle chart below, repeated breaks of Fibonacci support of the post Covid rally, along with lower highs and lower lows in concert with unrelenting downside long term price momentum, revealed by MACD in the lower panel, the technical condition continues to be abysmal leaving little reason to begin to add exposure to most EM equities.

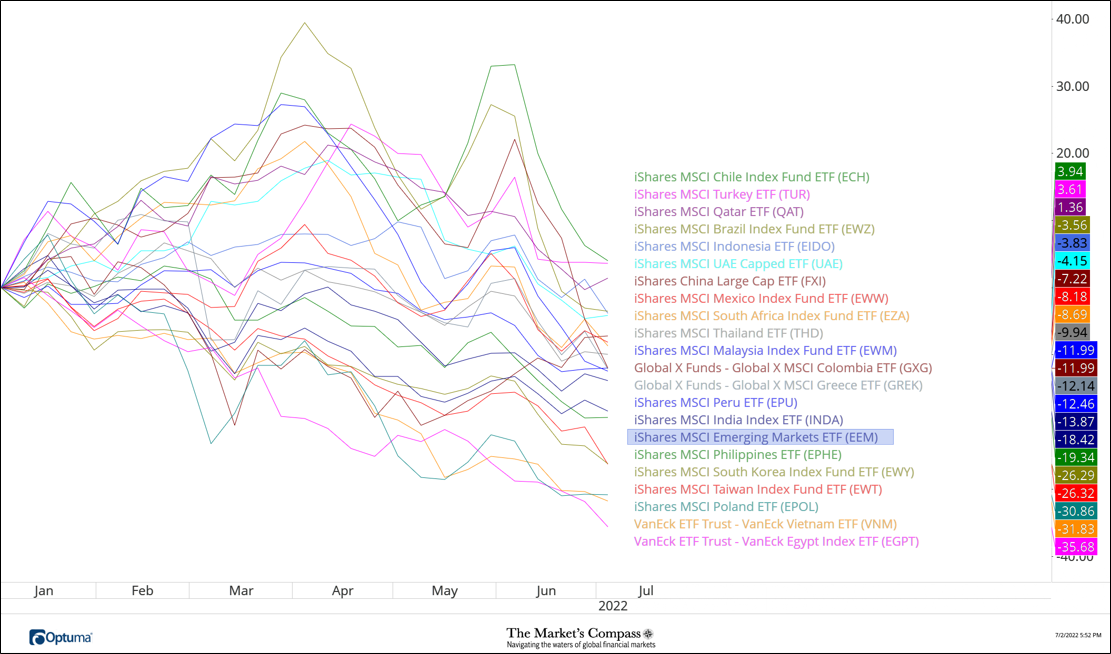

Absolute Performance of the 22 Emerging Market Countries ETFs Year to Date*

*Does not include dividends and the RSX which is still not trading.

Additional confirmation of the poor recent technical condition of the LatAm ETFs over the last three weeks can be seen in the chart of the absolute performance of the 22 EM Country ETFs since the start of the year. The top three absolute performers three weeks ago were all Lat Am ETFs. Since then, the iShares Chile Index Fund (ECH) has fallen from being up +19.97% on the year to being up only +3.94% followed by the iShares MSCI Brazil Fund ETF up +8.76% three weeks ago to now down -3.56% on the year and the Global X MSCI Columbia ETF (GXG) from being up +12.53% falling to down -11.99% year to date. Whether this was a case of EM portfolio managers selling winners into the end of the quarter remains up for debate.

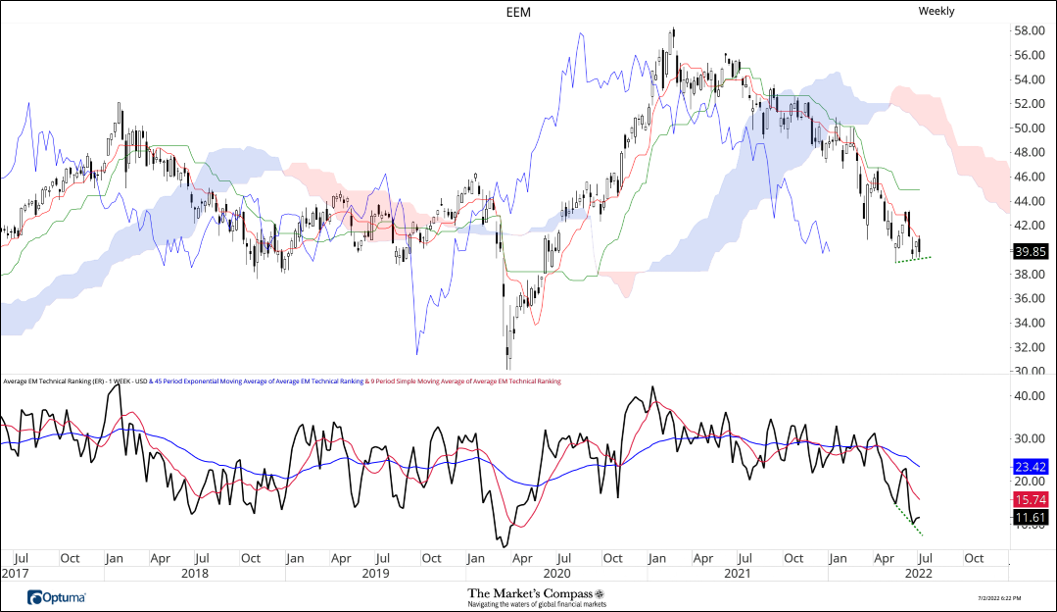

The Average “TR” Ranking of the 22 ETFs

The Average Weekly Technical Ranking (“ATR”) is the average Technical Ranking (“TR”) of the 22 Emerging Markets Country ETFs we track weekly and is plotted in the lower panel on the Weekly Candle Chart of the iShares MSCI Emerging Markets Index ETF (EEM) presented below. Like the “TER”, it is a confirmation/divergence or overbought/oversold indicator.

The Average Technical Ranking (“ATR”) of the 22 Emerging Markets Country ETFs fell to another new low two weeks ago to the lowest level (10.00) since April 2020 and only a feeble bounce has unfolded since then. The longer-term moving average (blue line) of the ATR left it sideways churn behind in early April and continues to track lower and the still declining shorter-term moving average (red line) continues to drop to lower levels underneath it. The EEM continues to grind in a series of lower highs and lower lows remaining in its unabated downtrend. The only potentially positive technical feature is that the EEM did not mark a new weekly closing low when the ATR did (green dashed lines). We would only declare this a bona fide non confirmation and a potential buy signal if the EEM prints a weekly higher high close above the 43 level. We are not “holding our breath”.

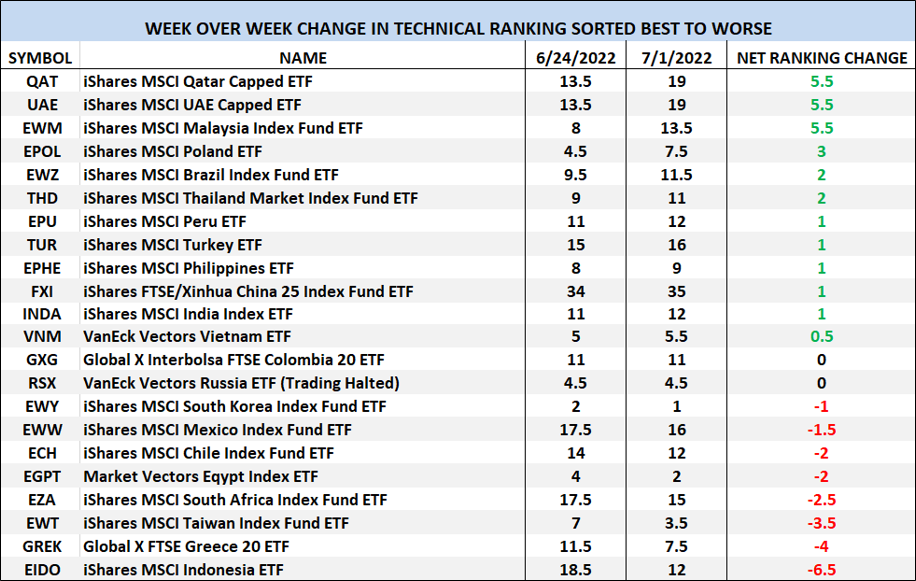

The Week Over Week Change in Technical Rankings

Twelve of the twenty-two EM Country ETFs we track saw week over week improvement in their TRs, two were unchanged one of which, the Van Eck Vectors Russia ETF (RSX) has been at 4.5 since trading was halted in late February and 8 ETFs saw their TRs loose ground. The largest drop was registered by the iShares MSCI Indonesia ETF (EDIO) which fell -6.5 “handles” to 12 from 18.5 (five weeks ago the EDIO had a TR of 39). Two EMEA ETFs saw improvement in their TRs. Both the iShares MSCI Qatar Capped ETF (QAT) and the iShares MSCI UAE Capped ETF (UAE) rose by 5.5 to 19 from 13.5. The average gain in TR of the ETFs was +0.28.

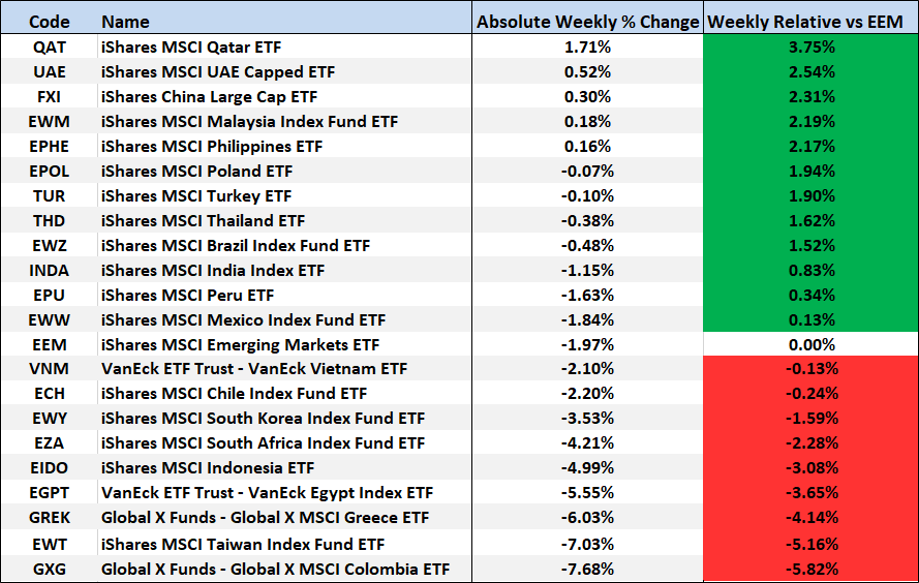

The Emerging Markets Country ETFs Weekly Absolute and Relative Price % Change*

*Does not including dividends, the VanEck Vectors Russia ETF (RSX) is again, omitted.

Five of the 22 Emerging Markets Country ETFs we track gained ground on an absolute basis last week. The top two were also the top two TR gainers, the iShares MSCI Qatar ETF (QAT) rose +1.71% and the iShares MSCI UAE Capped ETF (UAE) was up +0.52%. Mentioned earlier in the blog was the iShares China Large Cap ETF (FXI) up +0.30%. Twelve EM ETFs outperformed the iShares MSCI Emerging Markets ETF (EEM) on a relative basis which was down -1.97% on the week and 9 EM ETFs underperformed. The average absolute decline of the 22 ETFs was -2.19%. On the week, the worst performing ETF on an absolute basis and relative basis was the Global X MSCI Columbia ETF down -7.68% and -5.82% respectively. That was the fourth weekly decline and a -28.33% decline since June 6th (see chart below).

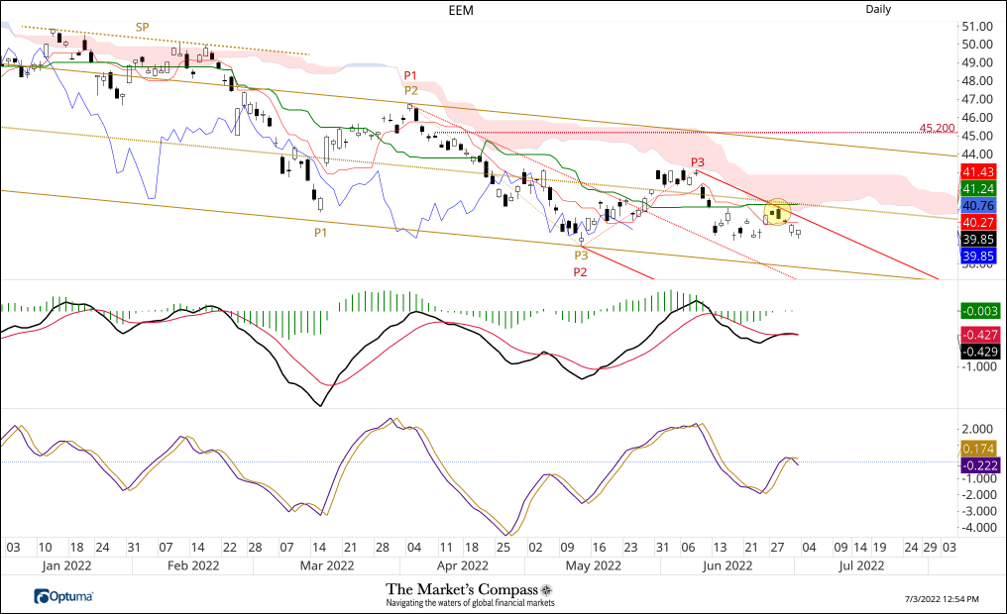

Thoughts on the Short-Term Technical Condition of the EEM

At the time of our last published technical thoughts on the EEM in the June 13th edition of the Emerging Market Country ETF Study the EEM had three days before been capped by resistance at the bottom of the Cloud (see chart above). That price pivot, at red P3, give birth to the new shorter-term Standard Pitchfork (red P1 though P3) Last Tuesday the EEM was capped again at not only at the bottom of the Cloud model but also by the cluster of significant resistance at the Median Line of the longer-term Schiff Pitchfork (Gold P1 through P3), the Kijun Plot (solid green line) and the Upper Parallel (solid red line) of the Standard Pitchfork (yellow circle). There is one positive feature regarding the technical condition of the EEM, and that is, unlike so many other equity ETFs and Index ETFs, the EEM has not printed a lower low beneath the pivot low in the middle of May (gold P3 and red P3). Saying that, the EEM has been in a sideways trading pattern for the past 14 trading sessions in what strikes us as only a pause in the downtrend. After briefly overtaking its signal line MACD is beginning to roll over again. The Fisher Transform, which often leads turns in MACD has rolled over below its signal line. Any resumption in the downtrend in Chinese equities will likely lead to a test of support afforded by the Lower Parallel of the Schiff Pitchfork at 37.50-37.75 level.

For readers who are unfamiliar with the technical terms or tools referred to above can avail themselves to a brief tutorial titled, Tools of Technical Analysis or the Three-Part Pitchfork Papers on The Markets Compass website…

All charts are courtesy of Optuma. All ETF holdings and GDP data is courtesy of Bloomberg. I invite our readers to contact me with any questions, comments or suggestions at…[email protected]