FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 631.70 to 628.61 (-0.49%) compared to last month’s update. Singapore REITs index is trading sideways near the support level. It remains to be seen if the REIT index will break the support, which has been tested in April 2024.

- Short-term direction: Sideways

- Medium-term direction: Sideways

- Long-term direction: Sideways

- Immediate Support: Blue Support Line

- Immediate Resistance: 50D SMA and 200D SMA

FTSE REIT Index Chart (2 years)

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on February 16th, 2025.

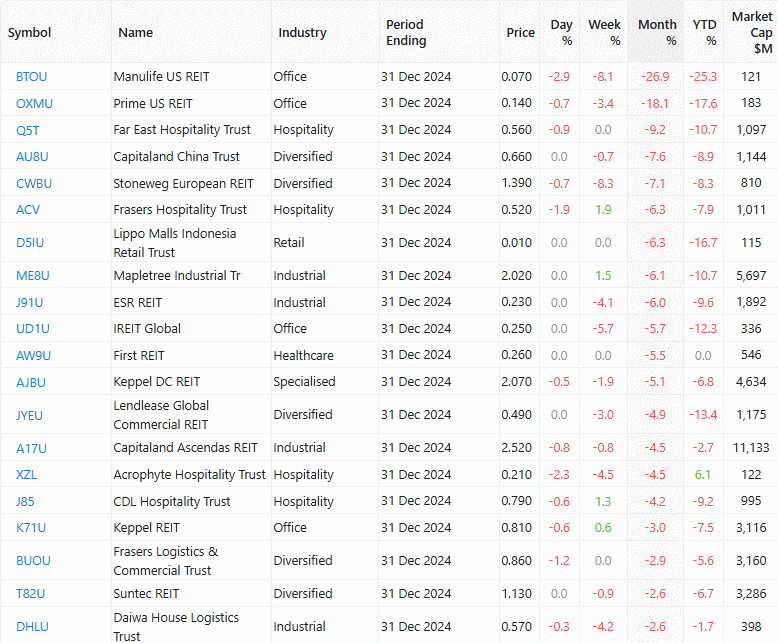

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- REITs highlighted in orange have the latest Q4 2024 values, otherwise they have the Q3 2024 values.

- I have introduced weighted average (weighted by market cap) to the financial ratios, in addition to the existing simple average ratios. This is another perspective where smaller market cap REITs do not disproportionately affect the average ratios.

Data from REITsavvy Screener. https://screener.reitsavvy.com/

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of March 11th, 2025.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs are referenced to SG Gov Bond Yield.

As of May 2024, all REITs’ Yield Spread will be referenced to SG Gov Bond Yields, regardless of trading currency.

Price/NAV Ratios Overview

- Price/NAV increased to 0.93 (Weighted Average: 0.93)

- Increased from 0.88 in February 2025.

- Singapore Overall REIT sector is slightly undervalued

- Most undervalued REITs (based on Price/NAV)

Prime US REIT 0.24 Acrophyte Hospitality Trust 0.27 Keppel Pacific Oak US REIT 0.30 Manulife US REIT 0.30 Lippo Malls Indonesia Retail Trust 0.35 OUE REIT 0.48

Distribution Yields Overview

- TTM Distribution Yield increased to 6.30%. (Weighted Average remained at 6.27%)

- Increased from 6.15% in February 2025. (Weighted Average was 6.27%)

- 19 of 38 Singapore REITs have ttm distribution yields of above 7%.

- Yield Spread widened to 3.66%. (Weighted Average tightened slightly to 3.90%)

- Widened from 3.30% in February 2025. (Weighted Average was 3.92%)

- From May 2024 onwards, all my yield spread measurements are now in relation to SG Gov Bond Yields, no longer a mix with US Gov Bond Yields.

Gearing Ratios Overview

- Gearing Ratio decreased to 38.29%. (Weighted Average: 38.15%)

- Decreased from 39.52% in February 2025. (Weighted Average: 38.26%)

- Gearing Ratios are updated quarterly. All values are based on the most recent Q4 2024 updates.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

Manulife US REIT 60.8 EC World REIT 56.5 Prime US REIT 46.7 Keppel Pacific Oak US REIT 43.7 ESR REIT 42.8 Elite UK REIT 42.5 MUST and EC World REIT’s gearing ratio has exceeded MAS’s gearing limit of 50%. However, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to circumstances beyond the control of the REIT Manager.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation decreased by 0.18% to S$87.81 Billion.

- Decreased from S$87.81 Billion in February 2025.

- Biggest Market Capitalisation REITs (S$m):

Capitaland Integrated Commercial Trust 14815.89 Capitaland Ascendas REIT 11176.00 Mapletree Logistics Tr 6322.50 Mapletree Pan Asia Commercial Trust 6316.68 Mapletree Industrial Tr 5809.92 Keppel DC REIT 4528.45

- Smallest Market Capitalisation REITs (S$m):

Acrophyte Hospitality Trust 116.02 Manulife US REIT 128.45 Lippo Malls Indonesia Retail Trust 153.94 Prime US REIT 170.04 Elite UK REIT 178.26 Keppel Pacific Oak US REIT 219.33

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, scroll down for more information on the REITs courses.

Refer to the Detailed 2024 S-REITs Performance Here.

SG 10 Year Government Bond Yield

- SG 10 Year: 2.64% (decreased from 2.85%)

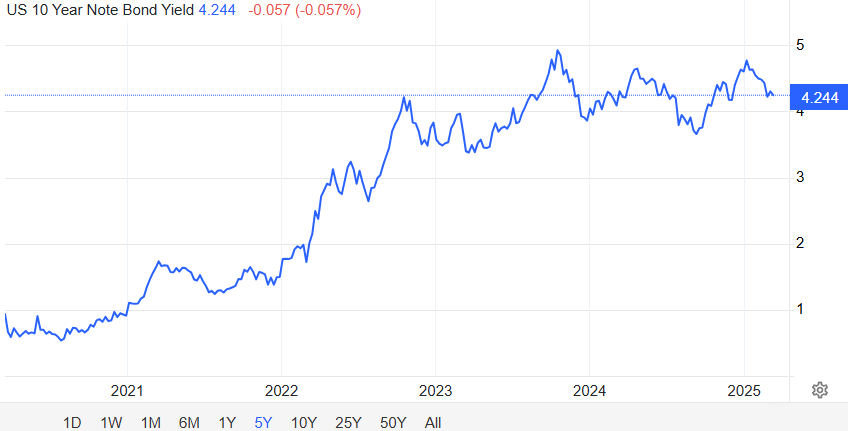

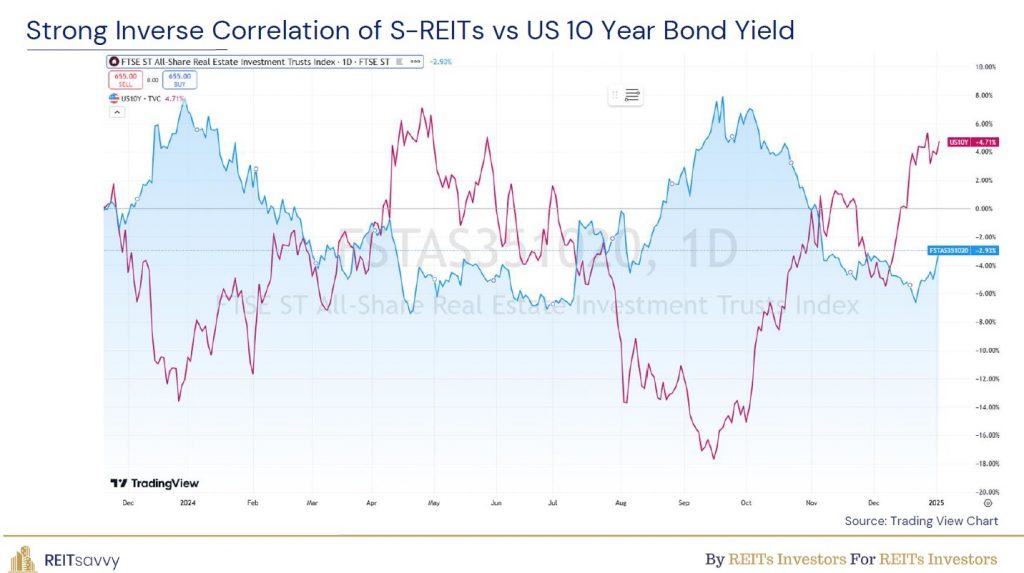

Singapore REITs sector is consolidating at the support level of about 619 of FTSE ST REIT Index. The US 10Y Risk Free Rate has dropped to 4.24% and currently forming a Triple Tops chart pattern. Singapore REITs sector has very strong inversed correlation with US 10Y Risk Free Rate and it is predicted the Singapore REIT may reverse to uptrend once there is a confirm trend reversal of the risk free rate.

US 10 Year Risk Free Rate

US 10 Year Risk Free Rate

Fundamentally, the S-REIT sector is trading at a 12% discount to its fair value, with an average trailing twelve-month (TTM) yield of 6.30%.

According to the current Fed Fund Rate projections from the CME Group, the market expects a 25 basis point cut by Q2 2025. The cut in interest rate will help to boost the DPU of the REITs which have shorter debt maturity profile and higher percentage of floating rate. However, the impact will only be reflected in the financial statement probably in Q2 or Q3 2025.

Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

You can join his Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

mystocksinvesting.com (Article Sourced Website)

#Singapore #REITs #Monthly #Update #March #11th #Stocks #Investing