Malaysia’s stock index reached a new peak in August, driven by strong economic growth. The country shows promise for investors due to its stable economy, growth in digital economy, and investments in data centers.

What happened?

Malaysia’s benchmark stock index has been scaling new peaks recently.

In August this year, the FTSE Bursa Malaysia KLCI (FBM KLCI) reached 1,678.80 points, its highest level since December 2020.

Source: Bursa Malaysia

Strong economic growth data drove the improved sentiment towards Malaysian stocks, with Malaysia’s GDP growing by 5.9% year over year in the second quarter of 2024.

The positive economic outlook has also helped to boost the Malaysia Ringgit, which appreciated by about 10% against the US Dollar in the first nine (9) months of 2024.

Why invest in Malaysia?

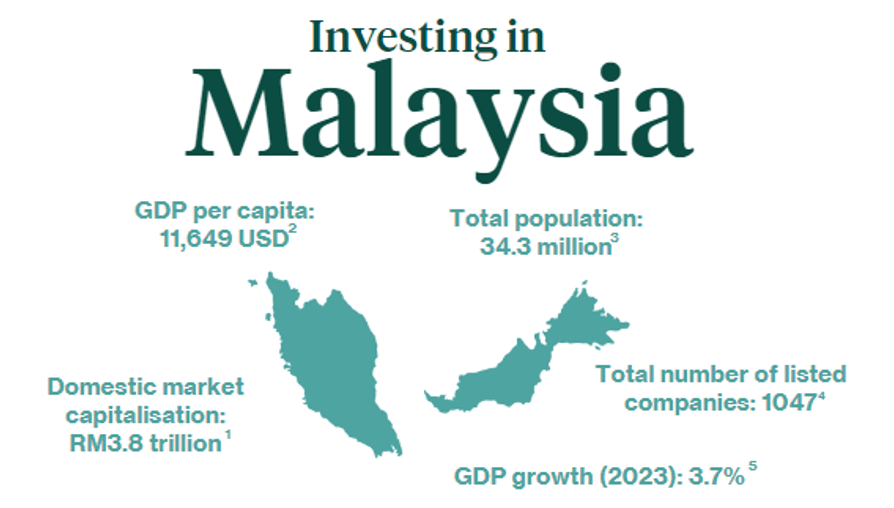

In addition to these recent developments, Malaysia offers several long-term structural drivers that make it an attractive destination for investors.

Key reasons to invest in Malaysia include its stable economic growth and currency, growth of the digital economy and investments in data centres, and strong consumer sector.

#1 – Strong Economic Growth

Malaysia’s economy has consistently demonstrated resilience and growth, mainly due to its well-diversified industrial base.

Despite being severely impacted by the COVID-19 pandemic, which caused the economy to contract by 5.5%, Malaysia experienced a remarkable rebound, with GDP growth surging to 8.7% in 2022 as global restrictions eased.

The country is now steadily progressing towards a full recovery, with growth levels expected to return to pre-pandemic figures. GDP growth over the past few quarters has also been accelerating.

The government’s initiative through the 12th Malaysia Plan (2021-2025) has supported growth. The plan aims to increase Malaysia’s economic development, enhance social well-being, and boost environmental sustainability.

As part of infrastructure development, the initiative includes significant investments in transportation infrastructure such as the East Coast Rail Link (ECRL) and expansion of the Klang Valley Mass Rapid Transit (MRT) projects.

The ECRL and the Klang Valley MRT expansion, which cost about RM75 billion and RM45 billion, respectively, will be completed in 2026 and 2030.

This will improve connectivity, enhance logistics, and stimulate trade. These projects aim to boost the efficiency of Malaysia’s transport network and help it become a regional logistics hub.

Through these, the government aims to achieve 4% to 5% growth in 2024 and 4.5% to 5.5% growth in 2025.

* indicates the government’s midpoint forecast for GDP growth in 2024 and 2025

#2 – Currency stability in recent years

Malaysia’s strong economic growth and modest inflation have allowed its central bank to maintain a stable monetary policy.

Bank Negara Malaysia (BNM) kept its benchmark interest rate unchanged for eight consecutive meetings through September 2024, creating a favourable environment for investors.

This stability has driven foreign capital inflows back into the Malaysian economy.

According to BNM data, total foreign holdings of Malaysian bonds surged to RM 290 billion in September 2024 from RM 265 billion in January 2024.

In fact, the increase of RM 9 billion in August 2024 would represent the largest increase since July 2023.

This has also supported the Malaysian ringgit, making it one of the best-performing Asian currencies against the US Dollar in the first nine months of 2024.

#3 – Growth of the Digital Economy

Malaysia’s digital economy has emerged as one of the critical pillars for future growth, driven by government initiatives, infrastructure investments, and a thriving tech ecosystem.

The government projects that the digital economy will contribute 25.5% of the nation’s GDP by 2025, up from 23.5% in 2023 and 22.6% in 2020.

The launch of the MyDIGITAL Blueprint in February 2021 was a landmark moment in Malaysia’s digital transformation journey. The country aims to establish itself as a regional leader in digital technology by 2030.

Under this plan, the government promotes the adoption of advanced technologies, particularly in sectors like manufacturing, services, and agriculture.

For example, the government is pushing for integrating automation and artificial intelligence in the manufacturing industry to encourage companies to digitise their production processes.

The goal is to boost competitiveness, particularly in the electronics, automotive, and electrical sectors, which are vital to the country’s exports.

In the services sector, Malaysia focuses on adopting digital tools to improve service delivery, enhance customer experience, and promote digital transformation.

This includes innovations in financial services, e-commerce, and health tech while fostering a supportive environment for startups and tech-based SMEs.

In agriculture, the government is advancing the use of innovative farming technologies, which include precision farming, drone usage, and AI-based analytics.

This aims to improve crop yields, optimise resource use, and mitigate the impacts of climate change.

Programmes like the National Agro-Food Policy support the development of sustainable farming practices, helping farmers transition to more modern, tech-driven agricultural methods.

#4 – Investments in data centres

Malaysia has recently emerged as Asia’s data centre powerhouse as demand for cloud and AI services is rising.

According to the Ministry of Investment, Trade, and Industry, investment in data centres reached RM76 billion between January 2021 and March 2023.

Earlier this year, Google committed to a US$2 billion investment to establish its first data centre and a Google Cloud region in Malaysia.

Similarly, Microsoft has unveiled plans to invest US$2.2 billion into expanding its cloud services infrastructure in the country.

In addition, Malaysian conglomerate YTL, through its utilities division, partnered with Nvidia to build AI infrastructure, with a total commitment of US$4.3 billion.

These investments will provide local businesses with more advanced cloud services, prompting digital transformation across many industries. They also highlight Malaysia’s growing importance as a hub for technology and digital infrastructure in the region.

Major tech companies diversifying their operations into Malaysia, coupled with the government’s support for digital transformation through MyDIGITAL Blueprint, presents investors with an opportunity to tap into the growing digital economy and technology sector.

#5 – Strong Consumer Sector

Malaysia’s consumer sector has been experiencing robust growth, driven by rising disposable incomes, a growing middle class and increased consumer spending.

The country’s average household income increased by 7.3% from RM7,901 per month in 2019 to RM8,479 in 2022.

Wage growth and the government’s economic policies aimed at boosting income levels across all segments of society bolstered income levels.

As Malaysia’s middle-income population grows, so does its purchasing power. This resulted in constant increases in consumer spending over the past few years. Overall, consumer spending grew by 4.6% from 2022 to 2023.

This, in turn, translates to more robust corporate earnings, particularly for companies exposed to the consumer sector.

What are some risks to look out for?

While Malaysia offers compelling investment opportunities, there are potential risks to consider.

- Macroeconomic risks: Malaysia’s heavy reliance on exports makes it vulnerable to global demand fluctuations, particularly in critical sectors like electronics and energy. Economic slowdowns in significant trade partners could affect Malaysia’s growth.

- Regulatory risks: Malaysia’s regulatory environment is evolving, and sudden shifts in government policies or regulations could impact sectors or individual companies.

- Currency risks: Exposure to the Malaysian Ringgit may present currency risks for investors. Fluctuations in the exchange rate between Ringgit and other currencies can impact investment returns. Currency depreciation may erode gains, while appreciation can enhance returns.

How can investors gain exposure to Malaysia?

Investors looking to tap into Malaysia’s market can explore various options, from direct stock purchases on Bursa Malaysia to exchange-traded funds (ETFs) that track the FBM KLCI.

In addition, many multinational companies, including those in the ASEAN region, have operations in Malaysia, particularly in high-growth sectors like financial and consumer sectors, offering indirect exposure to the country’s growth.

For example, Singapore-listed Singtel (SGX: Z74) holds a stake in Axiata Group (KLSE: AXIATA), one of Malaysia’s leading telecommunications companies. Several regional banks, such as UOB (SGX: U11) and OCBC (SGX: O39), also have banking operations in Malaysia. Kalbe Farma (IDX: KLBF), one of Indonesia’s largest pharmaceutical and consumer health companies, taps into the rising demand for healthcare products and supplies pharmaceuticals and health supplements in Malaysia.

Where can you find more resources on Malaysia’s stock market?

Conducting thorough research may allow us to capture growth opportunities and mitigate risks when investing in Malaysia’s stock market.

The Bursa Malaysia stock exchange website offers additional resources for the latest company announcements, products, services, and key trading statistics on Malaysia’s stock market.

Malaysia stock market at a glance

The total market capitalisation of of stocks listed on Bursa Malaysia was RM 2.045 trillion, with 1,043 listed companies (including REITs) as of end-September 2024.

Malaysia’s IPO market has been exceptionally active in 2024, with a record number of listings and robust investor interest, making it one of the most buoyant markets in the ASEAN region.

As of September 2024, Bursa Malaysia has recorded 35 IPOs and is on track to achieving its target of 42 IPOs by the end of the year. This would mark the highest number of listings since 2006, when the exchange saw 40 IPOs.

The Bursa Malaysia stock exchange operates through three markets – the Main Market, ACE Market and LEAP Market.

The Main Market is the primary exchange platform for larger companies with a strong history of operations and profitability. To qualify for listing, companies need to meet several criteria, including a minimum market capitalisation of RM500 million at the time of listing.

The ACE Market is a sponsor-driven platform catering to smaller companies with high growth potential. Unlike the Main Market, these companies do not need to have a minimum profit or operational track record to be listed.

The LEAP Market serves as a fundraising platform tailored to SMEs (small and medium-sized enterprises) that may not have established operating or financial track records. This adviser-driven market is specifically available to sophisticated investors, providing a more niche investment opportunity.

The financial sector accounts for 24% of the total market, followed by the consumer sector (14%) and industrial sector (12%).

Source : Malaysia stocks reach multi-year high. What’s driving the optimism?

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

Source link

#Malaysia #Stocks #Hit #MultiYear #High #Whats #Fueling #Optimism #Thailand #Business #News