Tuesday, December 17th, 2024 and is filed under New Mexico Oil and Gas Investing, Texas Oil and Gas Investing

Crude oil is one of the most vital commodities in the world, powering industries, transportation, and economies globally. For accredited investors, direct investment in crude oil and natural gas exploration provides an opportunity to diversify their portfolios and potentially tap into lucrative returns, as well as enjoy some significant tax benefits. However, this type of investing is not for everyone and comes with its unique risks and rewards. This article will explore crude oil investing, particularly as related to direct investments in crude oil and natural gas exploration for accredited investors, highlighting the qualifications, investment vehicles, potential returns, and risks involved.

What Are Direct Oil and Gas Exploration Investments?

Direct investments in crude oil and natural gas generally involve purchasing interests in exploration and production (E&P) companies, owning working interests in oil and gas wells, or investing in partnerships that develop and operate oil fields. Unlike traditional methods, such as investing in stocks of oil companies or oil-related exchange-traded funds (ETFs), direct investments in exploration projects offer a closer, more hands-on approach.

Accredited investors typically participate through two main vehicles:

- Working Interest Ownership: Through participation in a partnership that owns a working interest in a drilling program, investors purchase a share of the right to earn a proportionate share of net revenues generated by an oil and/or gas well. As an investor, you’re entitled to a portion of the profits, but you also bear some operational costs. Initially, this includes the drilling and testing phases, and upon successful testing, the expenses associated with putting the well into commercial production. These expenses are covered through your investment made into the partnership and through a well’s production life, monthly expenses are netted from the gross revenues earned by the well.

- Oil and Gas Joint Ventures (JVs): These partnerships pool funds from the investment group to finance a portion of a crude oil and gas exploration and production project. The JV is managed by a general partner, while the accredited investors share that role to earn significant tax benefits that can be taken against your active income. This is compared to LPs that were favored in decades past that limited deductions to passive income only.

Who Qualifies as an Accredited Investor?

Not everyone can engage in direct oil and gas investing in exploration projects. The U.S. Securities and Exchange Commission (SEC) sets strict criteria for determining who qualifies as an accredited investor, ensuring that only individuals or entities with sufficient financial capacity participate in these higher-risk investments. While regulation allows investments to be made by investors who do not meet these criteria, there are limitations and many companies choose to only allow accredited investors to join their projects.

To qualify as an accredited investor, an individual must meet one of the following:

- Income Test: Earn an income of at least $200,000 annually (or $300,000 combined with a spouse) for the last two years and expect the same or higher income in the current year.

- Net Worth Test: Have a net worth exceeding $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.

Licensed broker-dealers, investment advisors, and institutional investors may also qualify for direct investments in oil and gas.

Potential Benefits of Direct Oil and Gas Investments in Exploration

There are several benefits to direct investments in oil and gas exploration that may appeal to accredited investors:

- High Return Potential: Successful oil and gas investments in exploration can yield substantial returns, especially if a well is high producing. Investors may receive monthly revenue distributions, which represent their share of the net production profits.

- Diversification: Investing in oil and gas exploration can serve as a hedge against inflation and stock market volatility. Since energy demand tends to rise during periods of inflation, crude oil can offer a natural protection against economic downturns.

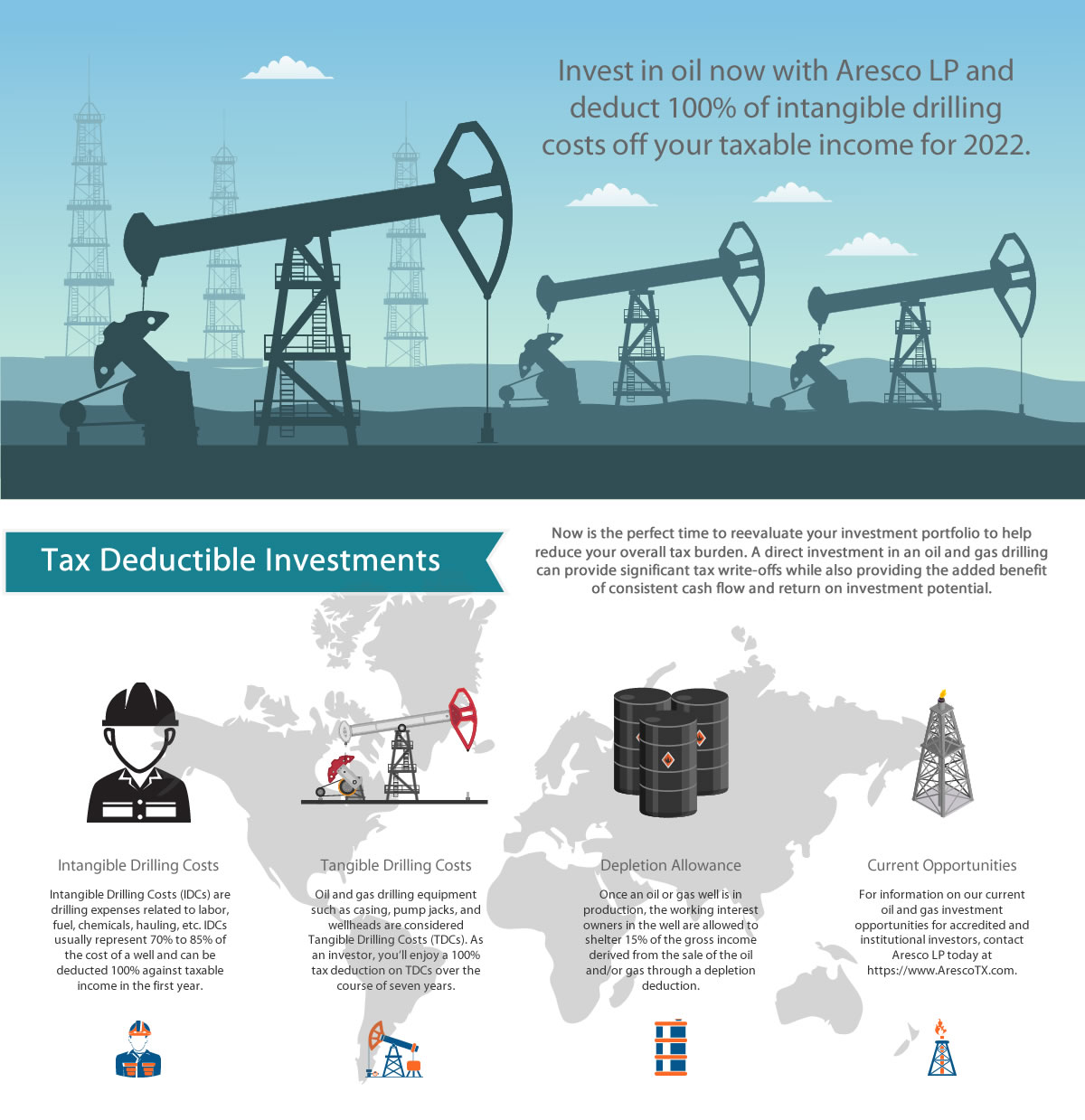

- Tax Advantages: The U.S. tax code provides significant incentives to oil and gas investors participating in exploration projects. For example:

- Intangible Drilling Costs (IDCs): A large percentage of drilling expenses can be written off in the first year, even if the well hasn’t produced oil yet.

- Depletion Allowances: Once production begins, investors can deduct a portion of the income generated from the well each year, compensating for the declining production value of the well.

- Long-Term Passive Income: Once a well is producing, it can potentially generate cash flow for many years, or even for a decade or two in some cases, offering investors the opportunity to establish a long-term passive income stream.

Risks Associated with Oil and Gas Investing in Exploration

While the potential rewards can be significant, direct investments in crude oil and natural gas exploration come with notable risks including the following:

- Market Volatility: Crude oil prices are notoriously volatile, influenced by geopolitical events, supply-demand imbalances, OPEC and OPEC+ decisions, and even natural disasters. Price fluctuations can affect the overall profitability of a well or field throughout its production life.

- Exploration Risks: Drilling for oil and natural gas is not a guaranteed success. Dry holes—where no commercially viable oil or gas is found—are a real possibility. Even with advanced technology, there is always a risk that a well will fail to produce, resulting in losses and the opportunity for passive income. However, dry holes result in a tax write off of the amount invested.

Understanding the Oil and Gas Investment Lifecycle

The life cycle of an oil and gas investment in exploration typically progresses through several stages:

- Prospect Development: Oil and gas exploration projects are born through the work of a crude oil and natural gas exploration company, and more specifically a geologist or geoscientist, that identifies possible reservoirs to target for exploration through the study a large volume of sub-surface data that may also include 3D and/or 2D seismic. This is a very lengthy process that can take years in some cases. If the study yields compelling data to support the exploration and testing of those reservoirs, the company will move into the next phase to drill the well and test the reservoirs.

- Mineral Leasing: Once an ideal drilling location, or locations in some cases, are identified, the exploration company must then acquire the necessary mineral leases before drilling and testing the targeted reservoirs. Mineral ownership was assigned to original landowners, dating back to sovereignty in many cases. This was generally on very large tracts of land, and as surface land was bought and sold through the generations, in whole or part, mineral ownership was commonly retained by the selling party and that ownership was passed down to children. Fast forwarding to today’s world of exploration, crude oil and natural gas exploration companies commonly rely on land professionals to locate mineral owners and secure the necessary leases so exploration can begin. Accredited investors often enter direct participation investments in crude oil and natural gas exploration projects just beyond this stage as projects are presented as joint ventures ready for drilling and testing.

- Drilling and Development: The drilling location is prepared and the rig, and other equipment, and personnel are brought in to drill the well on a 24/7 basis until its targeted depth is reached. Once the wellbore is successfully drilled, the testing phase begins where the exploration company, including the geological team, gain their first round of factual downhole data on the specific reservoirs being targeted through the project. If the initial testing and subsequent testing phases are successful with a confirmation of commercial production volumes, the project is then moved into one of the most exciting phases where the well begins its production life.

- Production: Once the well begins producing crude oil or gas, or in some cases both simultaneously, investors can expect to receive net income from their share of production. The duration of production can last from years to decades depending on the project specifics. Crude oil and natural gas reservoir are declining assets and reduced flow rates and pressures occur over time. Ideally, a newly established production stream experiences a very slow decline curve throughout its commercial life which could provide investors with long term passive income.

- Decommissioning: When a well is no longer economically viable, it is capped and decommissioned and the original location is restored to leave very little if any footprint of what existed during the well’s life. This phase carries expenses, which investors may have contributed toward through a fund that was started through the well’s production life to prepare for this time. In many cases however, the exploration company will trade this responsibility, at no cost to the joint venture group, to an oil and gas industry service company that would like to obtain the non-productive wellbore to covert it to a utility well for water production or saltwater disposal.

How to Get Started in Crude Oil Investing

For accredited investors interested in direct crude oil and gas investing, the first step is to research potential opportunities and find reputable operators or partnerships. Due diligence is critical to success in this space. Key considerations include:

- Exploration & Development Experience: Look for companies with a proven track record in the oil and gas industry. Seasoned operators can better navigate the challenges associated with exploration and production.

- Investment Structure: Each investment opportunity will have a different structure. Be sure to review the terms carefully, including the allocation of profits, tax implications, and your role as an investor.

Conclusion

For accredited investors, direct oil and gas investing in exploration offers a higher-risk, higher-reward opportunity. While this form of investing provides potential for significant returns, it is not for everyone. Investors should be prepared for the inherent risks, including the commitment of at-risk capital to secure the investment, exploration related risks such as dry holes, and market volatility with crude oil and natural gas price fluctuations. However, with careful due diligence, investments in oil and gas exploration can provide excellent portfolio diversification, passive income, and valuable tax advantages that make it a compelling option for those who qualify. Contact Aresco to see if you qualify and to learn more about our current crude oil investing opportunities.

Be sure to follow Aresco on Facebook.

Trump Victory Fuels Wave of Alternative Investments in Oil and Gas by Accredited Investors

7 Tax Deductions and Advantages Available for Direct Oil and Gas Investments

Source link

#Crude #Oil #Investing #Guide #Accredited #Investors