- Why it matters: For decades, the world has invested in America. Now, a global moment of clarity threatens to redirect trillions of dollars of capital inflows and diminish the U.S. in the international economic order.

The big picture: The U.S. receives nearly $2 trillion each year in foreign capital inflows.

- That includes investments in businesses and bank lending, as well as foreign investors buying U.S. stocks and bonds.

- America’s share of global capital flows has nearly doubled from where it was just before the pandemic, to 41%.

Then came the tariffs.

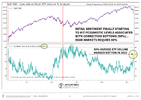

- The U.S. dollar — which should strengthen in a tariff environment, all other things being equal — weakened steadily.

- “This suggests foreigners have been and are continuing to sell U.S. stocks and sending their money elsewhere,” write Howard Ward and John Belton, co-chief investment officers of value at Gabelli Funds.

President Trump leads a Cabinet meeting at the White House yesterday. Photo: Nathan Howard/Reuters

The intrigue: A strong U.S. dollar has been orthodoxy for decades. Investors have counted on knowing the government would act to preserve the greenback as the world’s reserve currency.

- But Stephen Miran, chair of Trump’s Council of Economic Advisers, on Monday gave a speech in which he portrayed the strong dollar as fraught with downsides, denting U.S. competitiveness and labor.

- If the government isn’t going to stand as firmly by the dollar, investors may reason it’s a good time to look elsewhere, too.

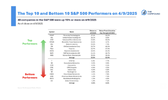

Between the lines: The tariff blowback only accelerates a trend that started not long after Trump took office, with investors preferring foreign markets over the U.S.

- The S&P 500 is one of the world’s worst-performing major indices so far this year.

- Asian and European shares rallied sharply yesterday — and U.S. stocks sank.

Reality check: For all the anxiety, the U.S. economy is still the world’s largest and remains attractive to plenty of investors.

Reality check: For all the anxiety, the U.S. economy is still the world’s largest and remains attractive to plenty of investors.

- Billions of dollars are still pouring into the U.S. to build new auto factories and data centers.

Bulletin: China today announced countermeasures by raising tariffs on U.S. goods from 84% to 125% starting Saturday. Get the latest.

Chinese President Xi Jinping has no shortage of pressure points to ensure Americans feel the pain from President Trump’s superpower trade war, Axios’ Dave Lawler writes.

- China has thus far imposed 84% tariffs in response to Trump’s levies, which are now up to an eye-watering 145%. But ever since Trade War 1.0, Beijing has developed an array of tools that it’s now putting to use.

Seven ways China can punch back as Trump continues to dial up the pressure:

- Hit consumers in the wallet. China’s factories produce the vast majority of the toys, cell phones and many other products Americans buy. From fast fashion to gaming consoles, things will get more expensive.

- Punish farmers (and more). Any American whose livelihood depends on selling into the Chinese market is likely panicking right now — whether the product in question is oil, airplanes or soybeans (three of the top U.S. exports).

- Target individual U.S. companies. China added twelve U.S. firms to an export control list this week — restricting what they can ship out of China — and added six defense tech and aviation firms to an “unreliable entity list” that bans them from doing business in China.

- Cut off supplies of rare earth minerals. China last week further restricted exports of rare earths — a sector it dominates — in response to Trump’s tariffs.

- Selling U.S. debt. There’s the “nuclear option” of dumping the $761 billion in U.S. bonds held by Beijing. This would likely ricochet back to hurt China.

- Devaluing the yuan. Another potential economic lever is a sharp devaluation of China’s currency, which would help boost China’s exports and further diminish the ability of U.S. firms to compete in the Chinese market. For now, though, Beijing has indicated it wants to keep the yuan stable.

- Freezing out Hollywood. China is a key market for U.S. films, sports leagues, and other entertainment products, and Beijing hasn’t been shy about using that leverage.

Oil News:

Friday, April 11th, 2025

This week, one may not have noticed that oil markets are still backwardated and that refiners are still buying oil because the general sentiment in oil markets soured to its lowest level in years. Seemingly ceaseless salvos of incremental import tariffs between the US and China frightened the oil markets to such an extent that even Trump’s 90-day delay on implementation for everyone except Beijing failed to trigger any change, leaving ICE Brent stuck around $63 per barrel.

EIA Warns of 2025 Demand Slowdown. The US Energy Information Administration lowered its global demand forecast for this and next year, expecting consumption to rise by 900,000 b/d in 2025, whilst lowering its annual Brent forecast to 68 per barrel, some 6 per barrel lower than its previous forecast.

US-China Trade War Has No End. In an escalatory spiral of import tariffs, China’s decision to mirror Trump’s tariff hike and take its tariff on US goods to 84% led to the US President lifting tariffs to an unprecedented 145%, debilitating a $585 billion trading relationship and, in turn, triggering a 125% riposte from Beijing.

Keystone Flows Shut After Dakota Oil Spill. The 622,000 b/d Keystone pipeline carrying Canadian heavy crude all the way down to Cushing was shut down after an oil spill saw the release of almost 3,500 barrels of oil in North Dakota, restricting heavy sour crude deliveries to US Midwest refiners.

Kazakhstan Tries to Talk Sense to Oil Majors. Kazakhstan has reportedly initiated talks with oil companies operating in the country, seeking a coordinated production cut after Chevron’s Tengiz field expansion brought production to a record high of 2.18 million b/d in March in defiance of OPEC+ quotas.

Trump Launches New Shipbuilding Mandate. US President Donald Trump signed an executive order aimed at rejuvenating the United States’ shipbuilding industry, authorizing the USTR office to start levying multi-million port docking fees on Chinese-built or Chinese-flagged tankers.

Indonesia to Become a LNG Importer Soon. The Indonesian government is considering starting LNG imports as soon as the third quarter of 2025, eyeing a deal with the Trump administration on prospective imports of US LNG to meet a shortfall of 50 LNG cargoes amidst plunging domestic gas output.

Saudi Arabia Finds an Array of New Fields. Saudi Aramco (TADAWUL:2222), the national oil company of Saudi Arabia, announced the discovery of 14 oil and gas fields in the kingdom’s Eastern Region and the Empty Quarter, but with incremental flows totalling 8,126 b/d, the size of new finds disappointed.

EU Walks Back Steel Tariff Retaliation. The European Commission suspended its retaliatory 25% tariffs on $24 billion worth of agricultural and industrial goods for 90 days after US President Trump capped tariffs at 10%, failing to react to the US’ 25% levies on steel, aluminium, and car imports.

Russia Restores Full CPC Pipeline Flows. Following a Russian court ruling that ordered CPC terminal operations to resume in full after Moscow tried to pressurizeKazakhstan over its OPEC+ non-compliance, the 1.6 million b/d flows of mostly Kazakh light sour CPC Blend have been restored.

Iranian Oil Exports Boom On Sanction Fears. China’s imports of Iranian crude surged above 1.8 million b/d last month, marking an all-time high, as increased sanctions pressure prompted Shandong refiners to stock up with sanctioned barrels even though prices of Iranian Light are now on par with Brent.

Brazil Expedites Upstream Auctions. Brazil’s government has decided to organize an extra upstream licensing round as soon as September 2025 to boost revenue, offering uncontracted parts of giant producing offshore fields such as Tupi, Mero, and Atapu, whilst looking to raise $3.5 billion in revenue.

Oman to Host First High-Level US-Iran Talks. Adding to this week’s bearish sentiment, US special envoy Steve Witkoff is set to meet senior Iranian representatives for direct negotiations over Tehran’s nuclear programme, to be held in Oman this Saturday amidst a new round of sanctions on the Middle Eastern country.

China Stops Exporting Rare Earths. Outflows of seven rare earth materials placed on Beijing’s export control list have stopped completely, with regional sellers declaring force majeure on their long-term contracts as the likes of samarium, terbium, and yttrium are unlikely to be shipped to US firms.

Capitulation

“This market won’t bottom until we see capitulation.” | ||

You’ll see a lot of that in the coming days and weeks. I strongly agree and disagree with parts of that sentiment. | ||

Blackrock reported earnings this morning. Larry Fink said, “We have not seen any capitulation with any clients.” He’s not going to. If you’re looking for long-term investors to throw in the towel, you haven’t been paying attention. | ||

In the five days leading up to (and including) the massive rally on Thursday, $10 billion came into VOO, 4x the normal rate. Another $19 billion rushed into SPY. | ||

| ||

Just keep buying isn’t just the name of Nick’s book; it’s become the mantra for millions of investors. In the United States, buying every dip has been rewarded for the last fifty years. It will take a long time for that muscle memory to fade. Don’t hold your breath. | ||

The Vanguardians of the Galaxy, as Balchunas calls them, will not be deterred. They will just keep buying, come hell or high water. | ||

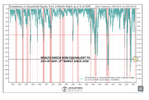

But there is another group of dip buyers that does need to capitulate before we see a durable bottom. It’s the degens. They plowed $7 billion into levered long ETFs in the five days leading up to the tariff-pause. They need to chill. | ||

For seven straight weeks they’ve plowed money into ETFs that go up twice as much or more as their underlying holdings. How much longer will they continue to touch a burning stove? | ||

| ||

On the flip side, speculators are also plowing money into inverse ETFs, so the chart above only tells half the story. | ||

This next one from Warren Pies shows that 50% of all speculative ETF volume (inverse and levered long) has been in inverse ETFs. This chart is a week old, so I assume we’re way higher now. Warren says that readings of 60% have a perfect one-year forward track record. I’m guessing we’re already there. | ||

| ||

Know who’s not capitulating, ever? Dividend investors. Yeah, I get that they might not be the most tax-efficient way to generate income, but from a behavioral point of view, they’re great. Assuming the world doesn’t end, and the dividends keep hitting your account, investors focused on this strategy are more likely to stay the course when the volume goes to 11. We spoke about that, and all of the craziness of the past week, on the Compound & Friends with the great Jenny Harrington. | ||

|

The US was the surplus country in last global trade war in the 1930s, while the UK, France, Germany, Austria, Russia were the deficit countries. That in the 1920s three of the five in Europe hyperinflated, while the UK & France significantly devalued their currencies. Then the US suffered a deflationary depression and ultimately won.

One of those countries was the global reserve currency at the time (UK).

Long-winded way of saying that Bessent’s platitudes, while confidently delivered, should not offer comfort.

Best case, this gets messy. The worst case? 10% of Eurasia’s 1913 population died in war from 1914-45.

In the end the Trump Administration will have to devalue the debt after an economic calamity; they will just likely have to do so at the time the market dictates it to them, rather than doing so first. Which would have allowed the Trump Administration to seized the initiative. The history books will likely record this as a badly-missed opportunity.

Gold will benefit going forward.

The first test may come in the late April Quarterly Refunding Announcement (QRA). If Bessent has to upsize UST issuance guidance for either cal-2q (unlikely given 2024 asset price boom) or more likely upsize cal-3q UST guidance (either outright, or via TGA drawdown) the Trump Administration will likely have an immediate credibility problem. This will manifest as stocks down, DXY down, 10y UST yields up, gold up.

Which is what we are already seeing. It can get a lot worse.

The Trump administration is trying to accomplish a number of very expensive undertakings using a blunt tool, tariffs. They want to:

1. Reshore manufacturing, which;

2. Will readjust capital flows and;

3. Conjointly address trade deficits.

The problem is that you cannot successfully accomplish these three goals while the debt remains as it is. The debt must be restructured first. Which means that the Fed must return to full blown QE or YCC (they are the same thing).

To date, Powell is trying to channel Paul Volcker.

When Volcker played hardball, Debt/GDP was +/- 30% not 125%

As the stock market continues to fall, US Tax receipts will start to fall also. This (obviously) makes the Debt/GDP number even worse.

jog on

duc

www.aussiestockforums.com (Article Sourced Website)

#April #DDD