AI trading strategies are changing the game for investors. With the right tools, you can create smart systems that spot market trends and make trades automatically. I’ve looked into the three AI trading platforms currently leading the race: TrendSpider, Trade Ideas, and Tickeron.

Each offers unique ways to build AI-powered strategies and different ways of powering their trading signals.

From my research, the reality is that TrendSpider’s AI Strategy Lab is the only AI that lets you train your custom AI models without coding. The AI can mix price data and indicators to find trade signals.

Trade Ideas uses AI-generated algorithms to scan the market and suggest real-time day trades. Tickeron offers pre-made AI strategies and portfolios.

These tools make it easier for anyone to use AI in trading. But it’s important to understand how they work and test them carefully. AI can find patterns humans might miss, but it’s not perfect. You still need to watch your trades and adjust your approach as markets change.

My Take on AI Trading Tools

- Most AI trading tools do not use real AI machine learning and large language models.

- The majority of self-proclaimed AI trading tools are algorithmic and do not actually learn.

- Each platform offers different features for creating and testing trading strategies.

- It’s crucial to understand AI limitations and monitor performance regularly.

Understanding AI in Trading

AI is changing how we trade stocks and other assets. It uses computer power to spot patterns and make predictions faster than humans can. Let’s look at how AI works in trading and why it matters.

Each approach brings distinct advantages and challenges, enabling traders to tailor strategies that integrate predictive analysis, real-time execution, and adaptability for optimal results.

✨

Algorithmic Trading

Automates trades using pre-set rules and historical data.

High-speed, precise trading suited for high-frequency markets.

Limited adaptability to real-time, unexpected events.

Limited by the quality of the rules and data.

✧

Machine Learning

Analyzes historical market data to uncover patterns and trends.

Makes predictions about future price movements based on past behavior.

Continuously learns and improves its algorithms with new data.

Struggles to adapt to sudden changes during live trading quickly.

֍

Generative AI

Creates synthetic data and simulates market conditions.

Useful for scenario analysis and stress testing.

Effective for risk assessment and forecasting.

Cannot execute trades directly; requires quality data.

My AI Trading Insights

Here are the main points to remember about AI trading strategies and tools:

- AI can help traders develop and refine strategies without needing to code, making it easier for traders of all skill levels to use AI in trading.

- Machine learning models like neural networks can predict market trends by analyzing historical data. This gives traders an edge.

- Tools like TrendSpider’s AI Strategy Lab are built specifically for trading, unlike general AI like ChatGPT.

- AI can improve technical analysis by identifying profitable trading signals more precisely than traditional methods.

- When choosing an AI trading tool, I recommend comparing features like strategy development, backtesting, and real-time alerts.

It’s important to understand that AI tools assist traders but don’t guarantee profits. Human oversight is still crucial for managing risk and making final decisions.

AI vs. Algorithmic Trading

Since 2007, I have been using algorithmic and backtested strategies. Now, it’s time to share with you the three top platforms on which I use AI for market analysis and strategy creation.

Algorithmic trading uses set rules to make trades. These rules don’t change unless a person changes them. AI trading is different. It can learn and adapt on its own.

AI strategies can be more flexible. They can adjust to new market conditions without human input, which can be helpful in fast-moving markets.

Algorithmic trading is often faster at making trades. But AI is better at making complex decisions. It can weigh many factors at once to find the best move.

1. TrendSpider: Real AI Models & Machine Learning

TrendSpider’s AI Strategy Lab is the market’s most powerful tool for creating custom AI-powered trading strategies. You can train your models and even crossbreed models together to create hybrid trading strategies. I find its platform to be truly amazing and especially useful for:

- Backtesting strategies using historical data.

- Creating unique models based on price action or a mix of hundreds of indicators.

- Finding unique trading ideas quickly.

- I will select the models I want to use, such as random forests, support vector machines (SVM), or K-nearest neighbors (KNN).

TrendSpider’s AI is built specifically for trading, unlike general AI like ChatGPT. This means it’s better at analyzing financial data and spotting trade signals. With its powerful algorithms and machine learning capabilities, TrendSpider can quickly scan through thousands of stocks and identify potentially profitable trades.

The platform also offers various charting tools, including automated trendline detection, multi-time frame analysis, and dynamic price alerts. These tools allow traders to easily spot market patterns and trends, giving them an edge in making informed trading decisions.

In addition to technical analysis tools, TrendSpider also offers fundamental data such as earnings reports and analyst ratings. This integration of both technical and fundamental data allows for

The platform also offers trade timing and execution tools, which help me implement my AI strategies in real-time markets.

2. Trade Ideas – Algorithmic Day Trading

Trade Ideas claims to be real AI, and the development of its unique algorithms and signals may well use AI in the development stage. However, what its customers get are automated algorithms.

You cannot train your LLMs or use machine learning directly like with TrendSpider.

That is not to say Trade Idea is not profitable or good; it actually has a great track record and is incredibly visual and easy to use.

I use it to:

- Get real-time trading signals.

- Finding unusual market activity.

- Test trading ideas with simulated trading.

The platform’s AI, Holly, runs millions of simulated trades nightly, which helps it adapt to changing market conditions.

I find Holly particularly useful for day trading and swing trading. It helps me stay objective and avoid emotional decisions. However, I always review its suggestions before executing trades.

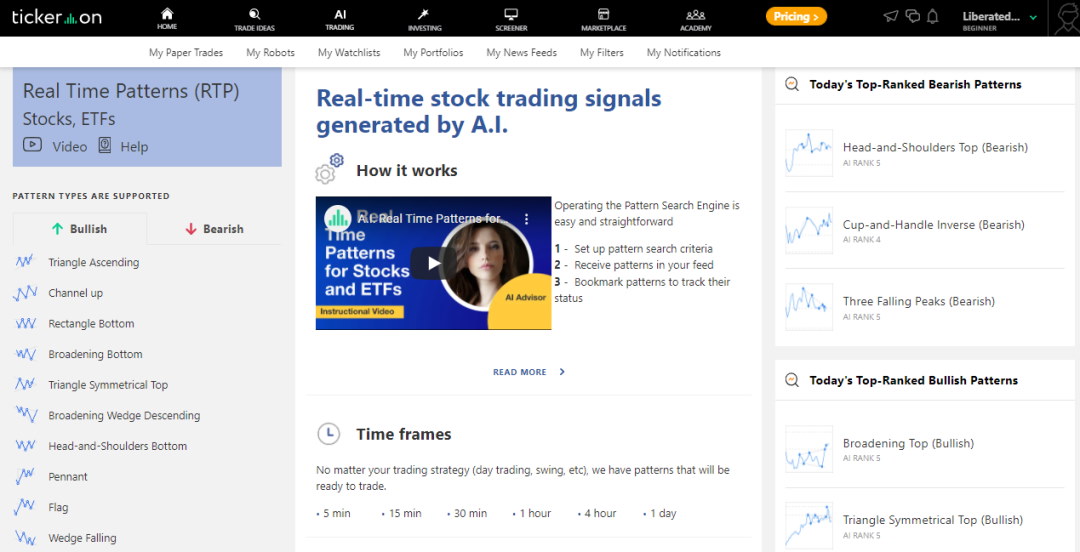

3. Tickeron – Pattern Recognition Algorithms

Tickeron’s AI focuses on pattern recognition and predictive analytics. Tickeron uses its FLM Platform, powered by proprietary Financial Learning Models (FLMs), to train these models with well-known financial concepts like patterns, indicators, and fundamental data. The company expects its FLMs to see huge demand, similar to how ChatGPT’s Large Language Models (LLMs) have made waves in the tech world.

Tickeron is easy to use and has a vibrant community, but while it is in the AI trading race, it is a distant third place behind TrendSpider and Trade Ideas.

I find it helpful for:

- Identifying chart patterns automatically.

- Getting AI-generated trade ideas.

- Analyzing fundamental data of stocks.

The Role of Machine Learning in AI

Machine learning is a key part of AI in trading. It helps computers learn from data without being told what to do. Historical market data is used to train these systems, which can then spot trends and make trading choices independently.

True AI trading systems can examine many factors simultaneously and discover brand-new strategies. They might check stock prices, news, and even social media. Their ability to consume vast amounts of data can help them make smarter choices than a single trader could alone.

Some AI tools use deep learning, a more complex form of machine learning. This type of learning can find hidden patterns in huge amounts of data, which can lead to better trading ideas.

Developing an AI Trading Strategy

Creating an effective AI trading strategy requires careful planning and execution. To help build robust AI-powered trading systems, I’ll explore key aspects like feature engineering, algorithm selection, and backtesting.

Guiding the AI

With true AI in trading (currently only available in TrendSpider), you can tell the machine what indicators, charts, and patterns you want to experiment with. Prompt engineering is crucial for AI trading strategies.

I start by identifying relevant data points that could influence market movements. This might include price action, volume, technical indicators, and even sentiment data.

For example, I might suggest using:

- Moving average crossovers

- Relative Strength Index (RSI) values

- Volume-weighted average price (VWAP)

- News sentiment scores

TrendSpider’s AI Strategy Lab allows me to use custom formulas or written explanations to build AI strategies based on price action or a mix of price and indicators.

Selecting the Right Models

Choosing the right algorithm is key to AI trading success. I consider factors like data type, strategy goals, and computational resources.

Common algorithms for trading include:

- Random Forests

- Support Vector Machines (SVM)

- Neural Networks

- K-Nearest Neighbors (KNN)

TrendSpider is the only tool that offers multiple machine-learning models, including Random Forest and KNN. This allows me to experiment with different approaches.

I often test multiple algorithms to find the best fit for my specific trading strategy and data set.

Backtesting Strategies for Reliability

Backtesting is vital to assessing an AI strategy’s performance before real-world use. I ran my strategy on historical data to see how it would have performed. You need to use a separate timeframe for AI testing than you used to train the AI. This will ensure that the strategy is robust and not overfitted to a specific period.

Backtesting is an essential step in developing any AI trading strategy. It allows traders to evaluate their strategies’ performance in a controlled, simulated environment before implementing them in real-world trading scenarios.

Many traders make the mistake of solely relying on backtested results without considering other factors, such as market conditions, news events, or unexpected occurrences. However, when done correctly, backtesting can provide valuable insights into a strategy’s strengths and weaknesses.

To perform backtesting, traders use historical data to run their AI strategy and see how it would have performed if applied to past market conditions. This method helps identify potential flaws in the strategy and make necessary adjustments before

I use tools like TrendSpider’s AI Strategy Lab to create, customize, and backtest AI-powered strategies. This helps me refine my approach and avoid overfitting.

I always use out-of-sample data for final testing to ensure my strategy generalizes well to new market conditions.

Key Trading Indicators and Parameters

Trading indicators and parameters form the backbone of AI trading strategies. These tools help analyze market trends, generate signals, and manage risk. Let’s explore the essential components that power effective AI trading systems.

Technical Analysis Indicators

Technical analysis indicators are crucial for AI trading strategies. I use the Relative Strength Index (RSI) to measure momentum and identify overbought or oversold conditions. Moving averages help smooth out price data and spot trends. I also incorporate the MACD (Moving Average Convergence Divergence) to detect momentum shifts.

Bollinger Bands are useful for gauging volatility and potential price breakouts. Volume indicators like On-Balance-Volume (OBV) provide insights into buying and selling pressure. By combining these indicators, I create a more robust AI model that can analyze multiple aspects of market behavior.

Trading Signals

Trading signals are the actionable outputs of AI models. I train my algorithms to recognize patterns and generate buy, sell, or hold signals based on market conditions. These signals often combine multiple indicators to improve accuracy.

For example, I might use a combination of RSI, moving average crossovers, and volume spikes to trigger a buy signal. AI models can process vast amounts of data to identify complex patterns that humans might miss. I always backtest my signal-generating algorithms on historical data to assess their performance before using them in live trading.

Utilizing Stop Loss (SL) and Take Profit (TP) Parameters

Stop Loss (SL) and Take Profit (TP) parameters are essential for risk management in AI trading strategies. I set SL levels to limit potential losses on each trade. This helps protect my capital if the market moves against my position. The benefit of real AI is that you can ask it to suggest the optimal stop losses and take profit levels for a system.

Tracking Performance through Backtesting

Backtesting is crucial for assessing a strategy’s historical performance. It allows me to simulate trades using past market data.

I pay close attention to total return and compound annual growth rate (CAGR). These show overall profitability and yearly growth expectations.

Risk-adjusted return metrics like the Sortino ratio are also important. They help me evaluate downside risk more effectively than the Sharpe ratio alone. I visualize performance over time using equity curves. They show cumulative returns and help identify periods of strong or weak performance.

Slippage and transaction costs must also be considered. They can significantly impact real-world results compared to theoretical backtests.

Risks

AI trading has some downsides. Data dependency: AI systems need huge amounts of quality data to work well. Bad or limited data can lead to poor decisions. Lack of human judgment: AI can’t factor in sudden events or market shifts like humans can, which may cause losses in unpredictable situations.

There’s also the problem of overreliance. Traders might trust AI too much and not check its decisions, which can be dangerous. AI systems can be complex and hard to understand, and their “black box” nature makes it tough to explain why certain trades were made.

Lastly, AI trading might lead to market instability. If many systems use similar algorithms, sudden market swings could occur.

These drawbacks don’t make AI trading bad, but it’s important to be aware of them when using AI in trading strategies.

The Future

AI trading strategies are evolving rapidly. New techniques and algorithms promise to reshape how we approach the markets. I expect major advances in how AI analyzes data and makes trading decisions. The Economist claims, “ChatGPT could replace telemarketers, teachers and traders.“

LLM-based feature engineering is an exciting new frontier. I’ve seen it used to analyze market sentiment from news and social media. This technique can extract tradable insights from unstructured text data. It goes beyond simple keyword matching.

LLMs can understand context and nuance in financial reports and flag subtle signals human analysts might miss. Some traders use LLMs to generate novel technical indicators. These AI-created features often spot patterns traditional indicators overlook.

I believe LLM-powered strategies will become more common. They offer a unique edge in today’s data-rich markets.

Reinforcement learning is another promising area. AI agents learn through trial and error in simulated markets, developing strategies that can be surprising yet effective.

I’m also excited about model crossbreeding, as seen in TrendSpider. This technique combines different AI approaches to create hybrid strategies, which often leads to more robust and adaptable trading systems.

FAQ

What tools are most effective in AI-driven trade decision-making?

Machine learning algorithms like neural networks work well for market prediction. Natural language processing helps analyze news and social media sentiment.

TrendSpider’s AI Strategy Lab is designed specifically for financial data analysis. It can more effectively identify trade signals than general-purpose AI.

Does TrendSpider support automated trade execution, and how efficient is it?

TrendSpider offers automated trading capabilities. It can execute trades based on predefined strategies and signals. The efficiency of the strategies depends on how well they are designed. Proper backtesting and optimization are crucial for good results.

What advantages do Trade Ideas offer over other AI trading platforms?

Trade Ideas offers advanced AI tools, such as the AI Gen. 2 Money Machine and HOLLY AI, which provide unique insights for day trading. It also offers real-time charts, broker integration, and a live trading room, which sets it apart from many competitors.

In what ways does Tickeron’s AI technology differ from other market analysis tools?

Tickeron uses AI to generate trade ideas and market forecasts. It focuses on pattern recognition in price charts and fundamental data.

Tickeron’s approach combines technical and fundamental analysis more thoroughly than some other platforms, giving a more rounded view of potential trades.

Source link

#Trading #Systems #Truth #Hype #Tools #Work