It’s been a tough year for the markets, with U.S. stocks posting their worst start to a year in over 50 years. The second half may bring additional woes, with investors increasingly on the lookout for a possible recession amid a slowdown in corporate and economic growth.

In response to these worries, there’s been a rotation in the markets back into defensive sectors over the past 2 weeks as economically sensitive stocks come under pressure, while growth stocks continue to sell off. As you can see in the chart below, the S&P 500 (blue line) and Nasdaq (red line) are trending below Healthcare, Consumer Staples and the Real Estate sectors, which are currently outperforming.

Healthcare (XLV), Consumer Staples (XLP) & Real Estate (XLRE) vs S&P 500 Index and Nasdaq – Last 2 Weeks

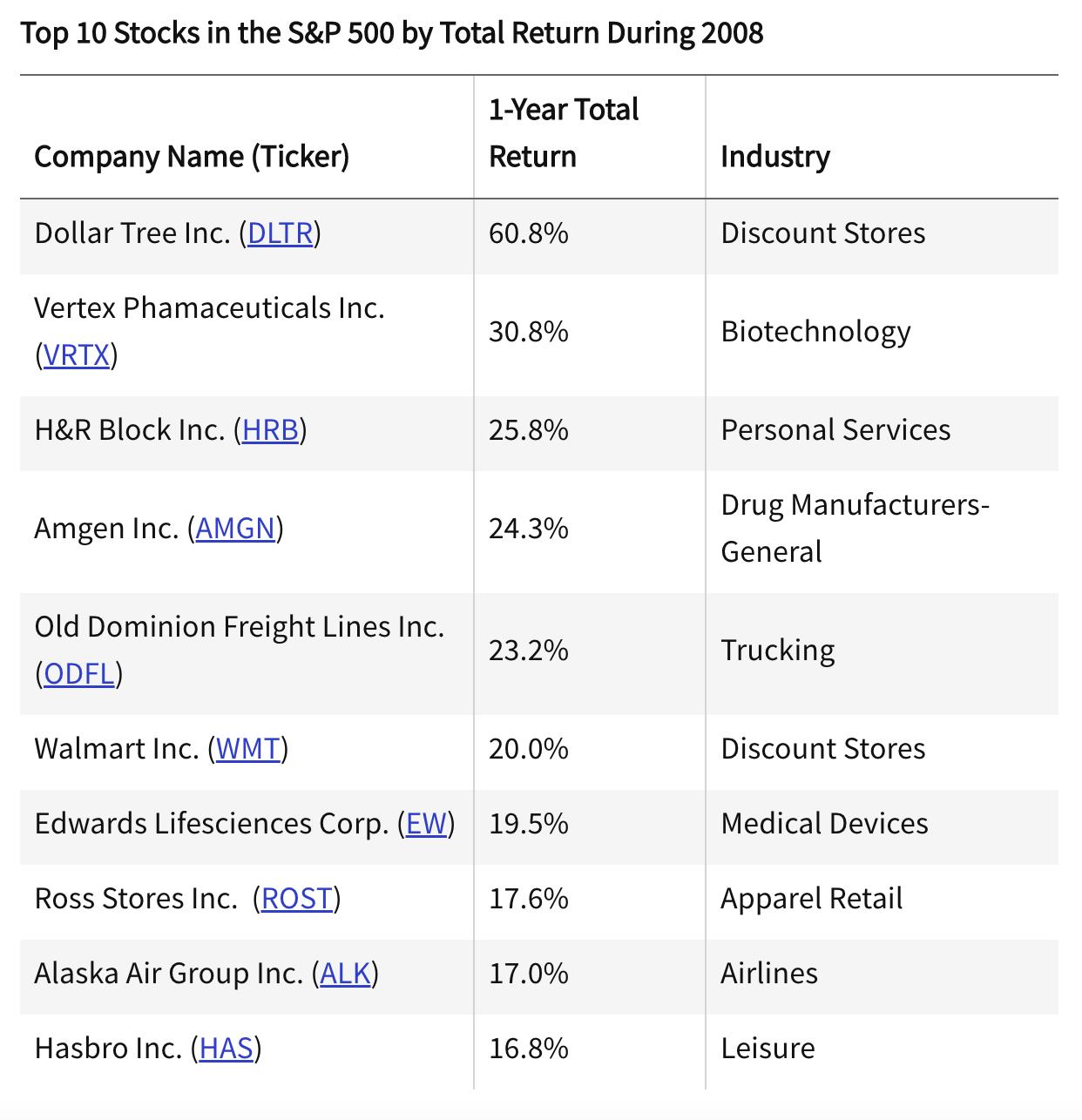

Other dynamics are also at play, with 1st Quarter GDP being reported last week as down 1.6% and below estimates, while Consumer Confidence fell to a 16-month low amid a slowdown in manufacturing. As the drum beats louder around the possibility of a recession, I took a minute to look at the top ten stocks that outperformed during the last sizable recession, which took place in 2008.

With the S&P 500 down 37% for 2008, it’s no small feat that the stocks listed above gained anywhere from 16.8% to a high of 60.8% for the year. A review of theses names shows that defensive Healthcare stocks and Discount Retailers dominated. Not among the top ten, but also posting a solid gain in 2008, was McDonalds (MCD), which would certainly qualify as a discount retailer.

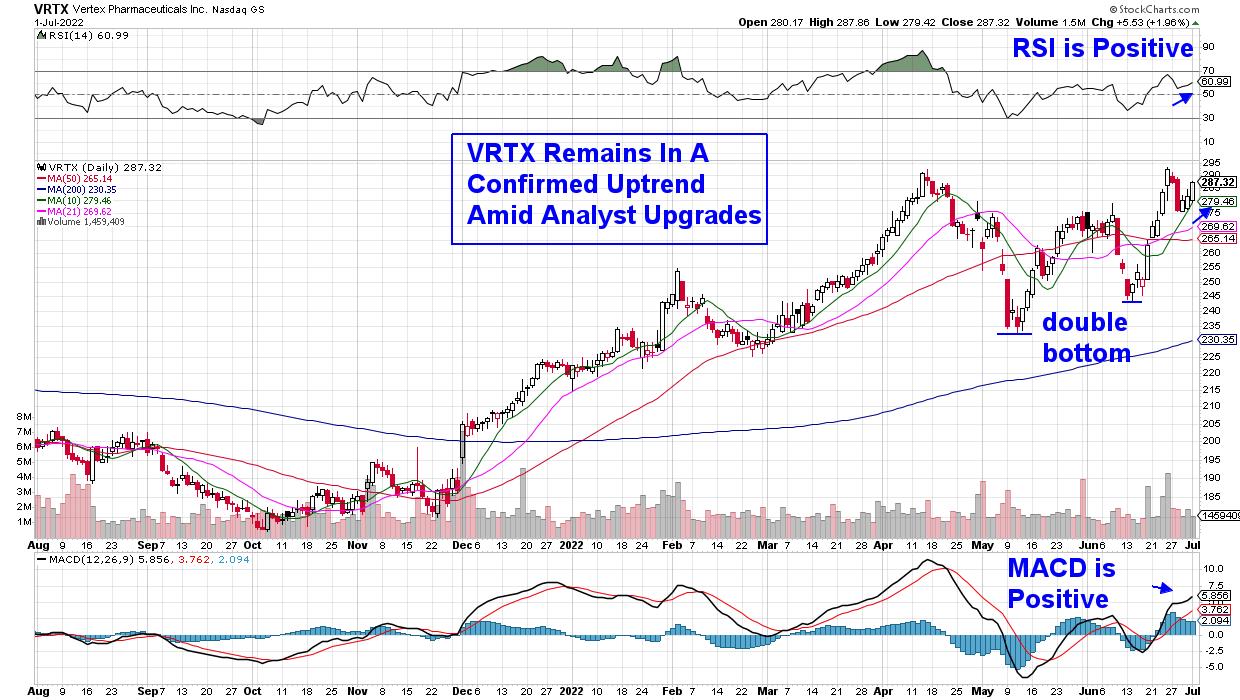

Below are select 2008 winners with their charts from today, as they’re exhibiting bullish characteristics in a period where anticipation of another recession looms. First up is Biotech stock Vertex (VRTX), which is in a strong buy zone as it approaches its recent base breakout level while in a confirmed uptrend.

VRTX has seen sales of its Cystic Fibrosis drug continue to expand while also announcing positive progress with its pipeline of drugs slated for approval later this year. All this good news has analysts raising earnings estimates for both this year and next, and, with a P/E of 19 times trailing 4 quarter earnings, the stock can be seen as a bargain.

DAILY CHART OF VERTEX PHARMACEUTICAL, INC. (VRTX)

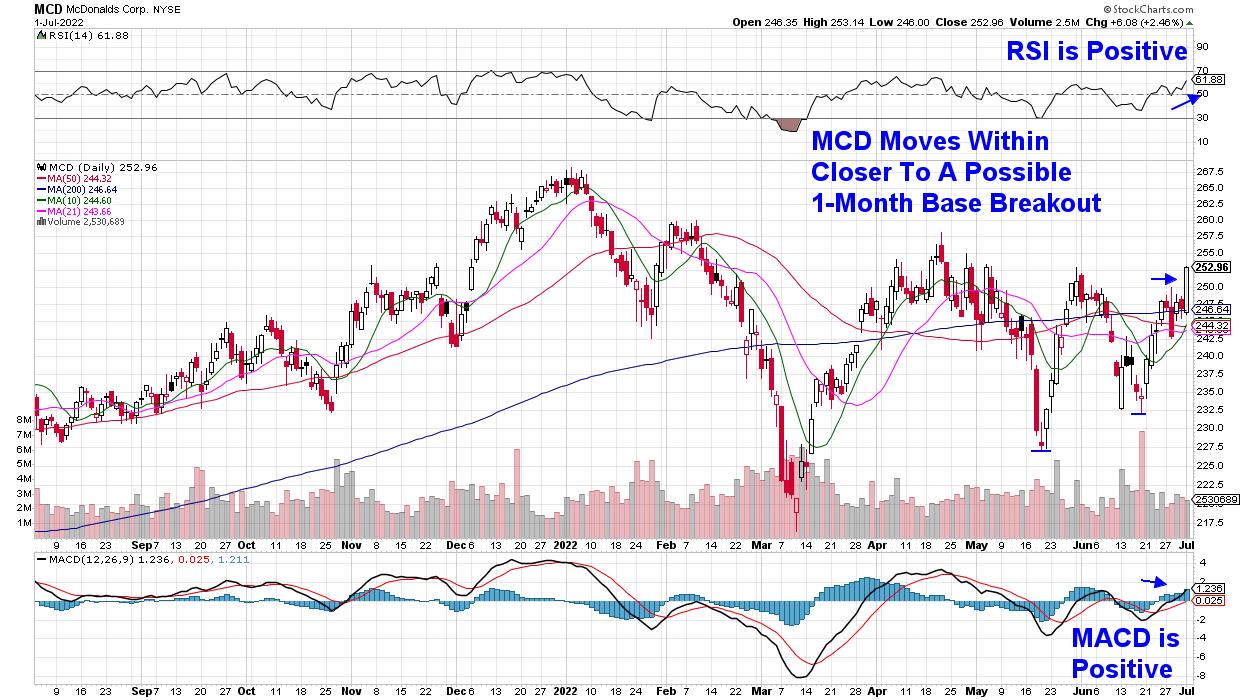

Next up is McDonalds Corp. (MCD), which was a top performer in the Dow today following a 2.5% rally that occurred on above-average volume. The move followed a Wall Street upgrade on Wednesday, where the company’s proven resilience during economically tough periods, coupled with a recent uptick in digital engagement that’s driving growth, had the analyst upgrading their price target to $278.

Last week’s gain puts MCD within a hair of a 1-month base breakout, and the stock currently has bullish characteristics in both its daily and as weekly charts. In addition, MCD is part of the Dividend Aristocrat group of stocks, which are companies that have raised their dividends each year for at least 25 years. MCD offers a 2.8% yield.

DAILY CHART OF MCDONALDS CORP. (MCD)

While the broader markets continue to struggle with both the S&P 500 and Nasdaq below key moving averages, there are pockets of strength, as evidenced by the stocks above and the recent move back into defensive areas of the market. More nimble investors can take advantage these pockets of strength–provided you have strict sell disciplines in place.

Subscribers to my twice-weekly MEM Edge Report have been provided with select stocks that are currently poised to trade higher, while also being kept up to date on the status of the broader markets. Exit strategies for those stocks are also provided. Use the link above to receive a 4-week trial of my MEM Edge Report at a nominal fee. You’ll also get immediate access to our most recent reports!

On this week’s edition of StockCharts TV’s The MEM Edge, I explain why Growth stocks suffered despite interest rates declining. In addition, I examine where the strength is in the markets and the best ways you can participate.

Enjoy the long weekend,

Mary Ellen McGonagle, MEM Investment Research

Mary Ellen McGonagle is a professional investing consultant and the president of MEM Investment Research. After eight years of working on Wall Street, Ms. McGonagle left to become a skilled stock analyst, working with William O’Neill in identifying healthy stocks with potential to take off. She has worked with clients that span the globe, including big names like Fidelity Asset Management, Morgan Stanley, Merrill Lynch and Oppenheimer.

Learn More